Overview of USDA work requirements for SNAP starting January 2026

Beginning January 2026, the USDA will reinstate broader work requirements for the Supplemental Nutrition Assistance Program (SNAP). The change affects certain adults without dependents who receive benefits and have been subject to relaxed rules during recent pandemic-era waivers.

This article explains the key changes, who will be affected, exemptions, and practical steps households can take to prepare. It provides resources and a short case study to illustrate real-world impact.

What changes in the SNAP work requirements starting January 2026

The USDA’s new policy narrows previously issued waivers and restores time-limits for able-bodied adults without dependents (ABAWDs). The central change is a return to the 3-month limit within a 36-month period for SNAP recipients who are not meeting work or training criteria.

States will be required to track participation and report compliance. Some states may apply for limited waivers under specific local conditions, but the overall federal baseline becomes stricter than recent temporary rules.

Key elements of the new rules

- Reinstate the 3-month time limit for ABAWDs who do not work or participate in qualifying activities.

- Require 80 hours per month of work or qualifying activities, or participation in a work program.

- Allow states to request targeted waivers for areas with high unemployment or insufficient capacity to provide work placements.

- Increase reporting and verification standards for state agencies administering SNAP.

Who will be affected by USDA SNAP work requirements

The changes mainly affect adults aged 18 to 49 without dependent children who receive SNAP benefits and are not exempt. Beneficiaries already working 80+ hours per month or enrolled in qualifying training or workfare programs will generally remain eligible.

State agencies will identify recipients who do not meet the work or participation threshold and notify them about time limits and possible case changes.

Groups likely to face new limits

- Adults 18–49 with no dependents and no documented disability.

- Individuals who are unemployed and not actively participating in approved employment or training.

- Recipients who do not meet reporting or verification requirements imposed by state agencies.

Exemptions and special cases under the new SNAP work rules

Not everyone will be subject to the 3-month limit. The USDA rules continue to recognize important exemptions based on age, disability, caregiving responsibilities, and other circumstances.

Common exemptions

- Pregnant women and adults caring for a child under age 18.

- Recipients with documented disabilities or temporary medical conditions preventing work.

- Individuals participating in state-approved employment and training programs.

- Students enrolled at least half-time in college or vocational programs, when other student rules apply.

How to prepare and comply with the January 2026 changes

Recipients and community organizations should begin preparing now. Planning can reduce benefit disruptions and help people meet participation requirements.

Practical steps for SNAP recipients

- Check your state SNAP office website for notices about ABAWD rules and reporting deadlines.

- Document any work, volunteer, or training hours with written records, timesheets, or employer verification.

- Enroll in state employment and training programs early if you are not currently working 80+ hours per month.

- Request exemptions or medical verifications from your caseworker if you have qualifying conditions.

Actions for community organizations and employers

- Expand or advertise part-time, flexible positions and training spots that count toward SNAP participation.

- Partner with workforce agencies to place SNAP recipients in paid work experiences.

- Provide documentation templates (timesheets, letters) to simplify verification for beneficiaries.

Federal SNAP rules have long included a 3-month time limit for some adults without dependents. The January 2026 change restores that baseline after pandemic-era flexibility was reduced.

Case study: One household navigating the new SNAP work requirements

Maria is a 27-year-old single adult receiving SNAP in a mid-sized city. She is not working full time but enrolled in a part-time training program and does occasional freelance work.

To meet the January 2026 requirements, Maria tracked her hours, enrolled in a local workforce program that counts as participation, and submitted monthly timesheets to her state SNAP office. Because she reached 80 hours per month through combined training and freelance work, she avoided the 3-month time limit and retained benefits.

Where to get help and more information

If you or someone you help is affected, start by contacting your state SNAP office. State agencies will issue detailed guidance and timelines for compliance and exemptions.

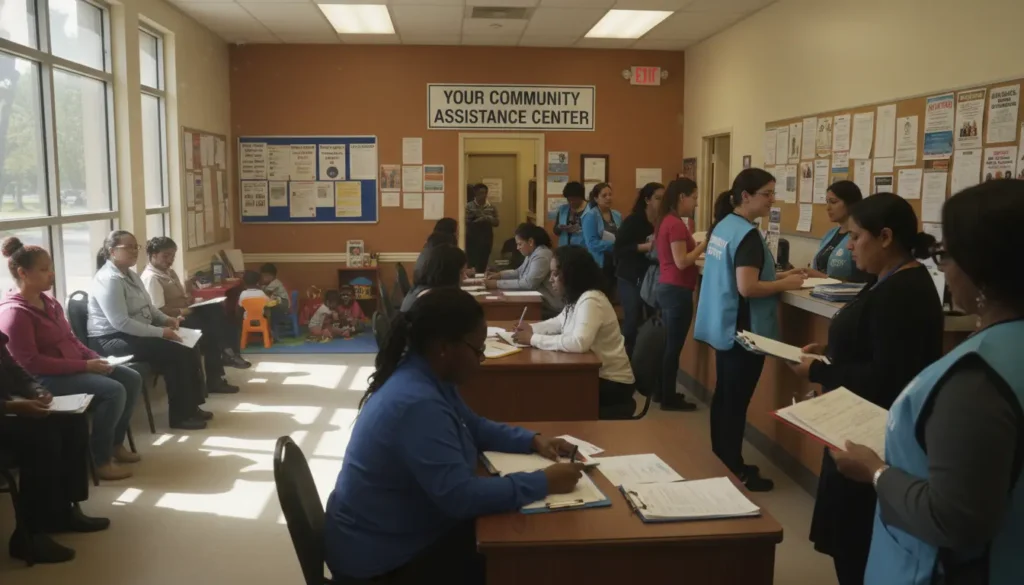

Other helpful resources include local workforce development centers, community action agencies, food banks, and legal aid clinics that specialize in public benefits.

Contact points

- Your state SNAP office website (search for SNAP or Food Assistance + your state name).

- Local workforce development boards and One-Stop Career Centers.

- Community organizations that provide case management and benefits counseling.

Final practical tips

- Keep clear records of work, training, and volunteer hours starting now.

- Ask your caseworker about exemptions if you have medical, caregiving, or educational responsibilities.

- Use local workforce programs to build a steady participation plan that meets the 80-hour threshold.

These steps can help reduce the risk of sudden benefit loss when the USDA work requirements take effect in January 2026. Staying informed and documenting participation are the best immediate actions recipients and advocates can take.