Overview of the $2000 IRS deposit for January 2026

This guide explains common eligibility rules and a practical payment timeline if a $2000 IRS deposit is scheduled for January 2026. It focuses on how the IRS typically determines eligibility and how payments are delivered.

Who is eligible for the $2000 IRS deposit in January 2026?

Eligibility will depend on the final law or Treasury guidance that authorizes the payment. However, similar federal deposits in recent years used these core criteria.

Primary eligibility rules

- Valid Social Security number for the taxpayer (and qualifying spouse if applicable).

- U.S. residency rules — most recipients must be U.S. residents for tax purposes.

- Filing requirement or non-filer registration — people who file returns or who the IRS has on record for benefits (Social Security, SSI) are easier to match.

- Income limits and phase-outs — many payments reduce or phase out for higher adjusted gross incomes (AGI).

- Dependency rules — payments usually exclude dependents unless the law states otherwise.

Expect the official guidance to list exact income thresholds, filing statuses, and any special rules for Social Security recipients or veterans.

Common exceptions and special cases

Certain groups are often treated differently under federal payment programs.

- Social Security, Railroad Retirement, or VA benefit recipients may receive automatic payments without filing a separate return.

- Nonresident aliens and some dual-status taxpayers are typically excluded.

- Incarcerated individuals may be ineligible depending on the law.

- People who owe certain federal debts or past-due child support may see reductions or offsets.

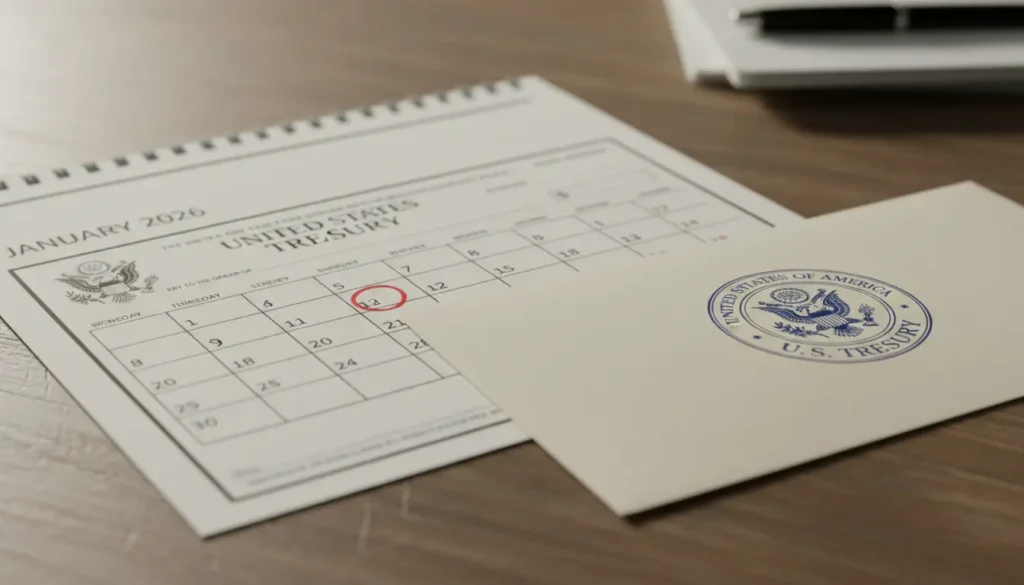

Payment timeline for the $2000 IRS deposit in January 2026

The IRS normally follows a phased delivery method when mailing and depositing large-scale payments. Actual dates depend on administrative preparations and Treasury schedules.

Likely schedule and sequence

- Late 2025: Official announcement, eligibility details, and an IRS timeline are published.

- Early January 2026: Direct deposits begin for taxpayers with bank account information on file.

- Mid to late January 2026: Paper checks and debit cards mailed to those without a direct deposit on file.

- Late January to February 2026: Correction cycles, unclaimed payments, and notices are processed.

Direct deposit payments usually arrive on business days and can post overnight. Paper checks and prepaid debit cards take longer due to mail times and processing.

How to confirm eligibility and payment status

Use official IRS tools and reliable documents to check status. Avoid unofficial sites requesting sensitive information beyond what the IRS would ask.

Step-by-step checks

- Visit the IRS website and look for a dedicated page or “Get My Payment” style tool if available for this deposit.

- Check your most recent tax return to confirm filing status, SSN, and direct deposit banking info are correct.

- If you receive Social Security or SSI, verify any IRS notices or automatic enrollment messages from your benefit administrator.

- Watch for official IRS letters outlining next steps if your payment is delayed or reduced.

How payments are delivered and how to update your payment method

The IRS typically prefers direct deposit for speed and security. If the IRS does not have your bank account, they may mail a check or preloaded debit card.

- Direct deposit: Fastest option. Confirm bank account and routing details on your tax return.

- Paper check: Mailed to the address on file; allow extra days for delivery.

- Debit card: Some programs use prepaid cards delivered by mail to reduce check processing.

What to do if you don’t get the $2000 deposit

If you believe you are eligible and did not receive a payment, follow these steps.

Troubleshooting checklist

- Confirm eligibility once the IRS issues official criteria.

- Check the IRS online tool for payment status updates and delivery details.

- Verify your tax return info: SSN, filing status, dependents, and bank info.

- Watch for IRS letters that explain an offset or ineligibility reason.

- If the payment was missed due to not filing, ask about a credit (for example, a recovery rebate credit) on your 2026 tax return if eligible.

The IRS usually delivers direct deposit payments more quickly than paper checks. If you want the fastest delivery, file your return with current bank information or register your direct deposit through the IRS tool when available.

Small real-world example

Case study: Alex is single with an AGI of $42,000 and a valid SSN. Alex filed a 2025 tax return and provided direct deposit information. When the $2000 deposit program was announced, Alex’s bank showed the deposit posted on January 12, 2026.

By contrast, Maria did not have direct deposit information on file. The IRS mailed her a paper check, and she received it three weeks later. Maria updated her tax account to add direct deposit for future payments.

Final tips to prepare

- Keep your address and bank info current with the IRS and Social Security if you receive benefits.

- Monitor the official IRS website and trusted news sources for the exact eligibility rules and calendar.

- Be cautious of scams: the IRS will not call to demand payment for release of the deposit.

This article provides a practical overview to help you understand likely eligibility rules and the typical payment timeline if a $2000 IRS deposit is issued in January 2026. Always confirm details with the IRS once the program is finalized.