The IRS has issued details about a December 2025 $2000 deposit program. This guide explains who is eligible, the payment schedule, and how to claim the deposit. Read the steps carefully and prepare the documents you will need.

What is the IRS December 2025 $2000 deposit?

The December 2025 $2000 deposit is a one-time payment announced by the IRS for eligible taxpayers. It is intended to help qualifying households with targeted financial support before the end of the year.

The deposit is handled through the IRS payment system and may be delivered by direct deposit, check, or debit card depending on IRS records for each taxpayer.

Who is eligible for the IRS December 2025 $2000 deposit?

Eligibility is based on income, filing status, and certain dependency rules. The IRS uses recent tax return information or data from benefit agencies to determine qualification.

Basic eligibility rules

- U.S. citizens or qualifying resident aliens with a valid Social Security number.

- Adjusted Gross Income (AGI) below the threshold set by the IRS for the tax year used to verify eligibility.

- Not claimed as a dependent on another taxpayer’s return.

- Filer must meet any additional criteria the IRS specifies (for example, not having certain outstanding debts ineligible for relief payments).

Income limits and qualifying conditions

The IRS typically sets income phase-out ranges by filing status (single, head of household, married filing jointly). Check the IRS announcement for exact AGI limits used for the December 2025 deposit.

If your AGI is near the limit, you may still qualify for a partial payment depending on the phase-out formula the IRS applies.

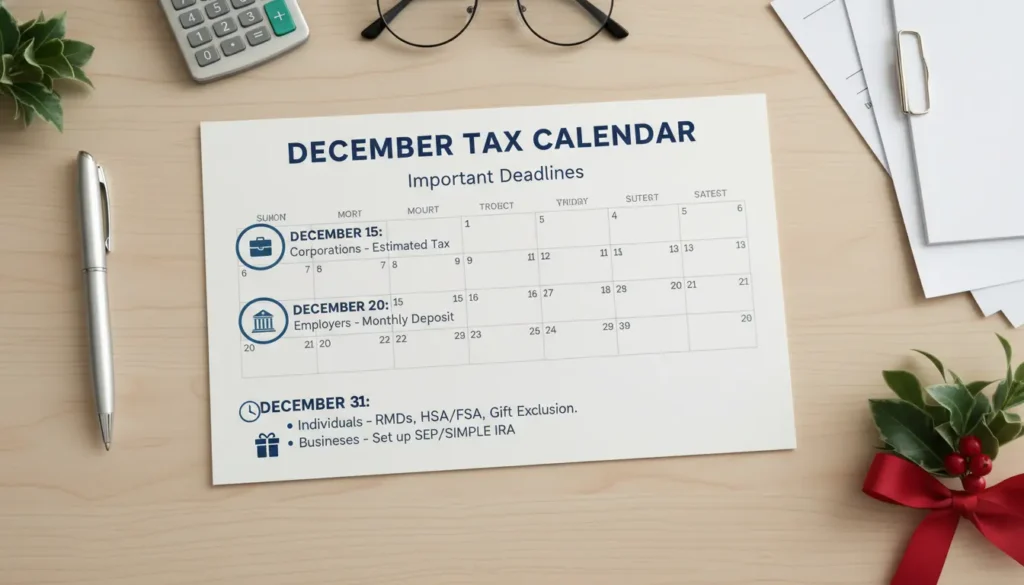

December 2025 $2000 deposit payment schedule

The IRS usually issues a schedule with specific deposit windows. For December 2025, deposits are expected to occur in staggered batches to manage processing.

How the schedule works

- Batch 1: Direct deposits to accounts on file — early December.

- Batch 2: Additional direct deposits and debit card deliveries — mid December.

- Batch 3: Mailed checks for those without bank details — late December.

Dates will be published on the IRS website and in official guidance. If you expect a deposit, monitor your bank account and mail in December.

How to claim the December 2025 $2000 deposit

If you are automatically eligible, the IRS will not require an application. However, some taxpayers must take action to claim or correct information.

Steps to claim or check eligibility

- Verify your most recent tax return is filed and up to date.

- Confirm your bank account information is on file with the IRS (via direct deposit on your return) or sign up for IRS online services.

- Watch the IRS portal and official notices for any action requests.

- If you did not receive a deposit and believe you were eligible, use the IRS online tool or file a claim when the IRS opens a process for non-recipients. Keep documentation of income and identity.

Failing to file a recent return may delay or block automatic qualification. If you normally do not file because your income is low, the IRS may offer a simple form or portal to register for the payment.

Documents and information to prepare

Gather these items to speed up verification or to file a claim:

- Most recent tax return (2023 or 2024 as designated by IRS).

- Social Security number or ITIN for all applicants.

- Proof of income: W-2s, 1099s, or benefit statements.

- Bank account and routing numbers if you want direct deposit.

The IRS can use either your most recent filed tax return or certain federal benefit records to verify eligibility for one-time deposits. If your address or bank changed, notify the IRS to avoid delays.

Common scenarios and examples

Different taxpayers will experience the payment process in distinct ways. Below are common situations and clear steps.

Example 1: Direct deposit to existing bank account

Maria filed her 2024 tax return with direct deposit details. The IRS verified her eligibility and deposited $2000 directly to her checking account in early December. She received no additional action items.

Example 2: No recent return filed

John did not file because his income was low. The IRS allowed a short registration process for low-income taxpayers. After submitting basic identity and income details online, he qualified and received a mailed check in late December.

What to do if you don’t receive the deposit

If you expected the December 2025 $2000 deposit and did not receive it, follow these steps:

- Check IRS notices and your online account for status updates.

- Confirm your bank account and mailing address on the most recent tax return.

- Use the IRS portal to submit a claim if a non-recipient process is available.

- Keep all supporting documents and screenshots of correspondence.

Small case study: Family receives partial payment

Ashley and Mark filed jointly with a combined AGI slightly above the full-eligibility threshold. The IRS applied a phase-out and issued a partial deposit of $1,200 instead of the full $2000. They received notice explaining the calculation and how to review the eligibility rules for future payments.

This case highlights the importance of checking AGI against published phase-out ranges and reviewing IRS notices carefully.

Final checklist before December 2025

- File or update your most recent tax return if required.

- Confirm bank and mailing details on file with the IRS.

- Gather proof of income and identity documents.

- Monitor IRS announcements and your mail throughout December.

Follow these steps to confirm eligibility and claim the IRS December 2025 $2000 deposit if you qualify. For official guidance, always rely on IRS announcements and the IRS.gov website.