Overview: What the big tax relief coming in 2026 means

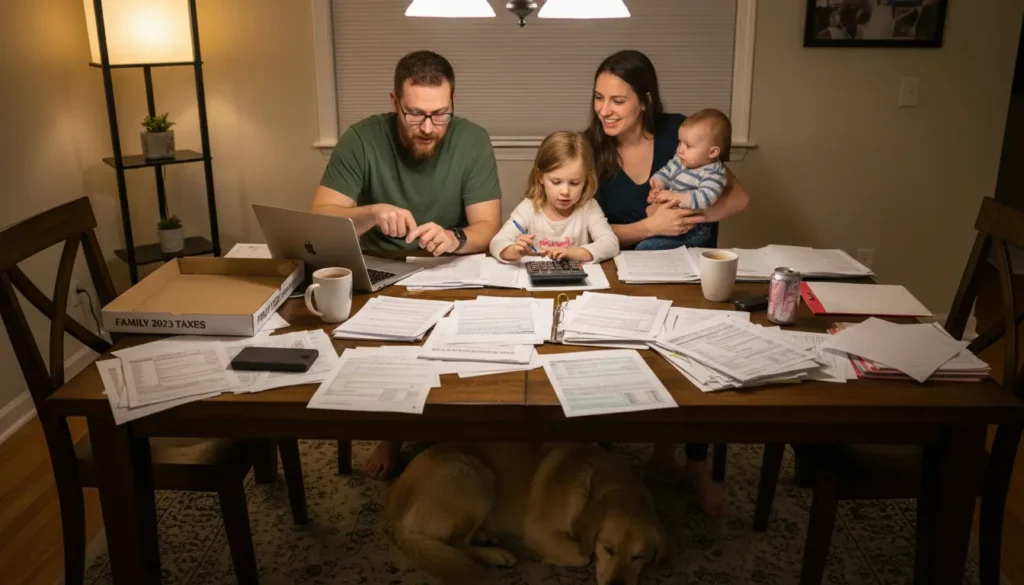

Starting in 2026, several tax changes and indexing updates are expected to affect taxable income and benefit rules for many households. Middle-class families and Social Security recipients should review these shifts so they can plan and possibly save.

This article explains the mechanisms behind the relief, who is likely to benefit, and practical steps you can take now to prepare.

How the big tax relief coming in 2026 will work

Relief generally arrives through two channels: automatic inflation indexing and policy changes passed by lawmakers. Indexing increases standard deductions and widens tax brackets, which can reduce the taxes owed without any action from taxpayers.

Policy changes—such as expansions of credits or changes to how benefits are taxed—can produce larger, targeted savings. Whether a household sees relief depends on income sources, filing status, and how Social Security is taxed for their situation.

Indexing and standard deductions

Each year the IRS may adjust the standard deduction and tax bracket thresholds for inflation. When these amounts rise faster than wages, taxpayers can move into lower effective tax rates or face smaller tax bills.

Middle-class families typically benefit when the standard deduction grows, because more income becomes non-taxable without needing to itemize.

Policy changes that could affect savings

Legislative changes may expand child-related credits, adjust earned income credits, or alter the taxation formula for Social Security benefits. Changes like these directly reduce tax liability or increase after-tax income for eligible recipients.

Because some measures require congressional action, it’s important to follow official IRS guidance and announcements for full details in 2026.

Who benefits: Middle-class families

Middle-class households often see relief in three main ways: reduced taxable income from a higher deduction, lower marginal rates when brackets widen, and access to credits aimed at families.

Families with children may benefit more if credits are expanded or made more refundable. Couples who previously owed additional tax could see that obligation shrink or disappear depending on income levels and deductions.

Practical impacts for households

- Lower tax withholding may increase take-home pay each paycheck.

- Higher deduction thresholds reduce the need to itemize and simplify filing.

- Expanded credits can directly reduce taxes owed or increase refunds.

Who benefits: Social Security recipients

Social Security recipients are affected in two ways: the cost-of-living adjustment (COLA) and taxation of benefits. A larger COLA raises income, while changes to taxation rules can lower how much of that income is taxable.

If lawmakers reduce the proportion of benefits subject to federal income tax, many retirees will retain a larger share of their Social Security checks.

Important considerations for retirees

- Watch the formula that determines how much Social Security is taxable based on combined income.

- Understand that increased COLA may raise Medicare premiums in some cases, so net benefit can vary.

- Plan distributions from IRAs and 401(k)s strategically to manage taxable income.

How to prepare now for the 2026 tax changes

Advance planning can help you capture available savings. Use these practical steps to reduce surprises when the new rules take effect.

- Review withholding: Update Form W-4 if you expect lower tax liability to increase take-home pay.

- Check benefits taxation: Estimate whether changes will alter the taxable portion of Social Security for your household.

- Maximize tax-advantaged accounts: Contribute to HSAs, 401(k)s, and IRAs to lower taxable income now.

- Meet with a tax professional: A planner can model scenarios under the new rules and suggest distribution timing.

- Update budgets: If relief arrives as higher take-home pay, allocate funds to debt reduction or emergency savings.

Many tax changes are applied automatically through inflation indexing, so some households will pay less tax without needing to file new paperwork.

Small case study: A simple example

Consider a married couple, retired, with combined social security and limited retirement income. Before 2026, a portion of their Social Security is taxable and their standard deduction leaves little room for additional savings.

If indexing increases their standard deduction and a policy shift reduces the taxable share of benefits, their taxable income can fall substantially. That lowers their federal tax bill and may increase monthly net income—money that can go toward Medicare premiums, groceries, or paying down debt.

Note: This is a hypothetical example for illustration. Exact savings depend on your income mix and the final 2026 rules.

Final checklist before 2026

- Estimate 2026 taxable income using current and projected changes.

- Adjust payroll withholding if you expect a materially lower tax liability.

- Consult a tax advisor about timing IRA or Roth conversions to optimize taxes under the new thresholds.

- Monitor IRS updates and official guidance in late 2025 and early 2026.

Big tax relief coming in 2026 could be a real advantage for middle-class families and Social Security recipients. Planning now will help you keep more of that relief in your pocket when the changes take effect.